How Does GovCon Financing Work?

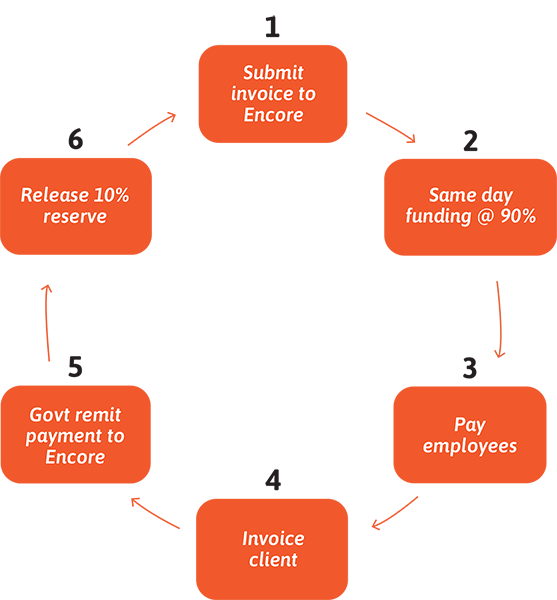

You can double your business overnight when you win a new government contract. Great! Now, your working capital needs to grow alongside your revenue, too. Encore Funding provides receivables funding for government contractors.

You gain advances against your accounts receivable, so you have the cash flow necessary to fulfill current contracts and bid for new contracts.

Simply present billed or unbilled invoices to Encore Funding. We advance up to 90% of the invoice, so you have cash on hand exactly when you need it. We can also provide cash even when the contract budget has been stalled so you can pay the necessary staff members.

The bottom line: the Encore Funding team helps government contractors work smarter, not harder. Our dependable, responsive experts and private lending help you stabilize your cash flow and seize big opportunities.

Big Benefits of Our Government Contractor Financing

Bid confidently with support from Encore Funding, where you can expect:

- Fast Cash: Working capital exactly when you need it.

- Financial Support Letter: Include in your RFP response and show capital wherewithal to stand up to large contracts.

- Responsive Team: Access dedicated, fast support.

- No Restrictions: Use funding in impactful ways based on your unique goals & objectives.

- Flexibility: Funding can grow or decrease based on your sales.

Alternative Funding & Beyond

We don’t just deliver alternative funding and walk away. We help you maximize it so you can scale from one business stage to the next.

Government Contractor

Financing

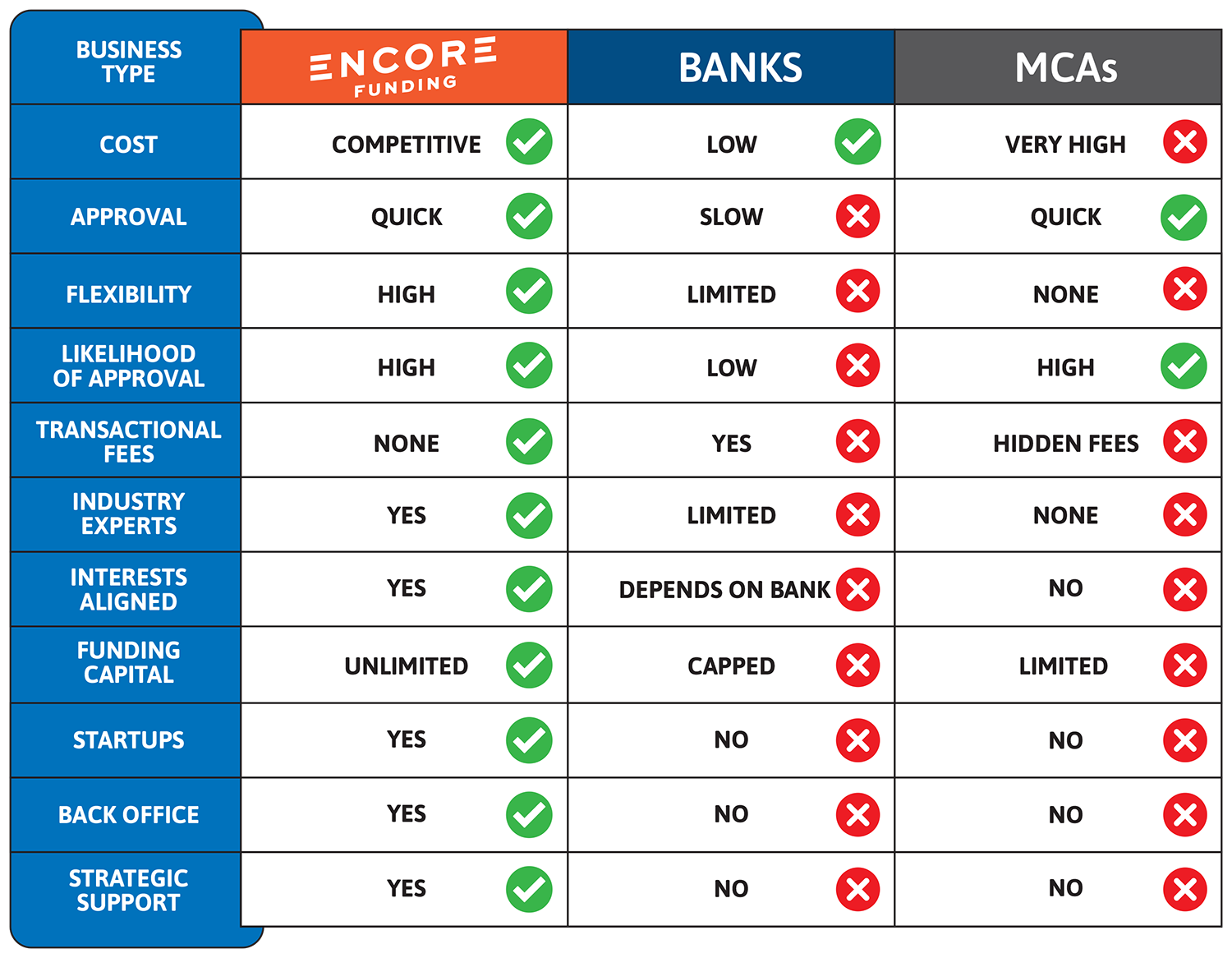

Maintain steady cash flow while your government contracting business grows. Move beyond the bureaucracy and limitations of traditional banks and corporate lenders. We purchase outstanding invoices at competitive rates with dedicated support for credit monitoring and collections.

Back Office Technology & Support

Eliminate the administrative burdens that impede productivity. Our comprehensive back-office technology streamlines invoicing, project management, compliance reporting, freeing you to focus on what matters most: expanding your government contracting operations.

SME Strategic Consulting

Achieve your objectives with our proactive support, industry expertise, and vendor connections. Our seasoned advisors guide you on cost reduction, cash flow protection, and finding fulfillment in your business journey.

Advantages to Receivables Funding vs. Tradtional Bank Lending

Reliable Receivables Funding for Government Contractors

Gain an expert team and fast, simple government contractor funding. Fill out our quick form and our team will reply within one business day.

Government Contractor Financing Insights & Advice

How to Find the Right Agencies for Your Government Contracting Business

By: Eric Coffie | Founder & CEO of GovCon Giants As someone who has spent years advising government contracting businesses, I see firsthand how the industry evolves. Opportunities in government contracts continue to grow, but so do the risks. As a seasoned industry leader, I want to share the top five mistakes I see countless…

Read More5 Mistakes to Avoid in Government Contracting

By: Eric Coffie | Founder & CEO of GovCon Giants As someone who navigates the complex and dynamic world of government contracting, I see firsthand how the landscape evolves. Opportunities in government contracts continue to grow, but so do the risks. As a seasoned industry leader, I want to share the top five mistakes I…

Read MoreLet’s Connect to Talk About Your Goals

Do you have funding questions or other business needs? We’ll connect you to one of our industry experts right away.

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900