Know the Differences Between Traditional and Alternative Government Contractor Financing

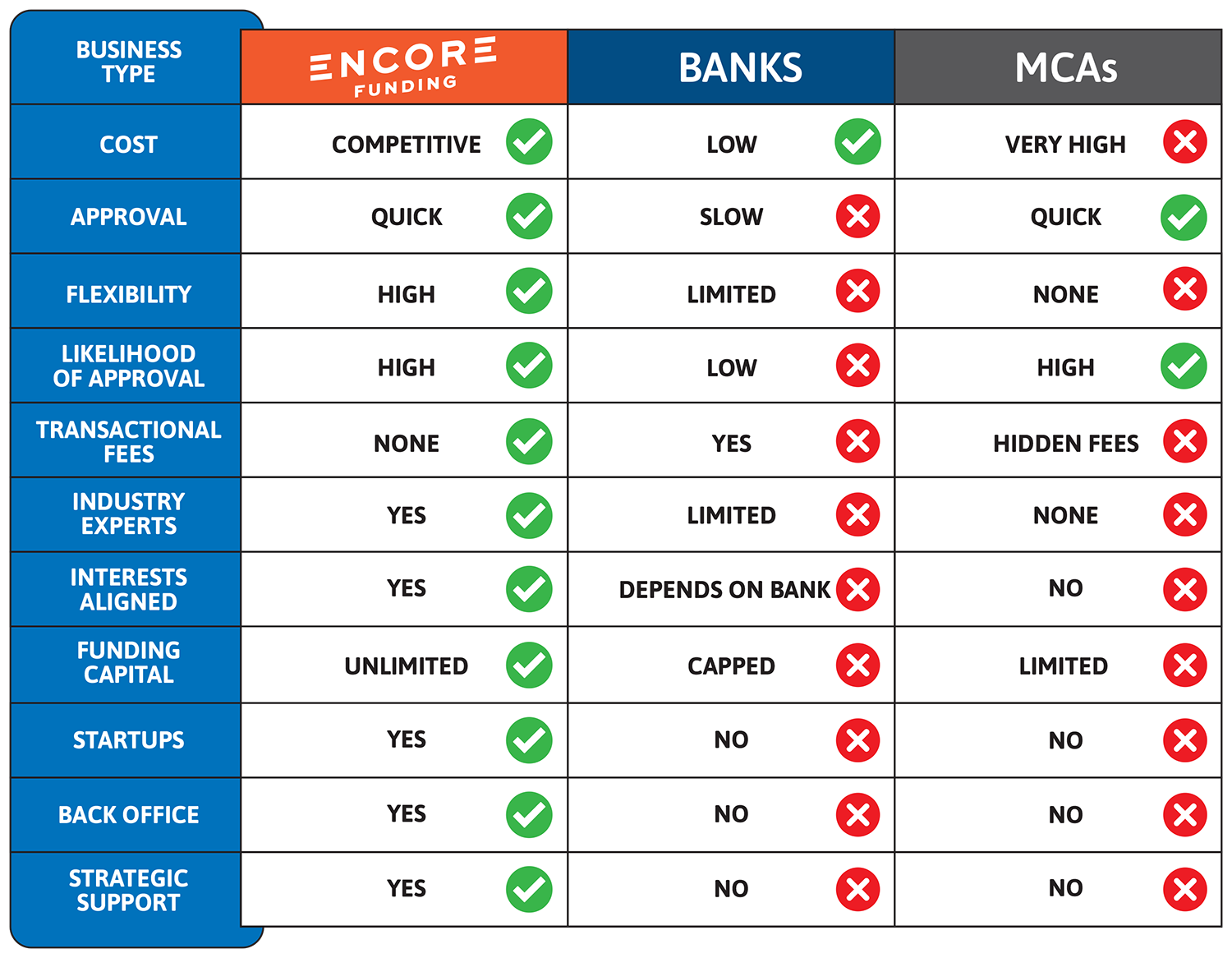

When securing funding for government contracts, you must often decide between traditional bank loans and alternative government contractor financing. The key differences can significantly impact your ability to maintain cash flow and meet the project demands.

Let’s dig into the main pros and cons of traditional bank loans versus alternative government contractor financing.

Cost and Speed of Government Contractor Financing

Traditional bank loans have lengthy approval processes and usually require extensive documentation, high credit scores, and collateral. These often delay access to funds. While they offer lower borrowing costs, the slow process may not suit your need for quick capital.

In contrast, alternative government contractor financing like receivables funding and Merchant Cash Advances (MCAs) provide faster access to cash, often within 24 to 48 hours, though at higher rates. The choice depends on your financial needs and cost management.

Alternative Funding for Government Contractors

There are several options when it comes to government contractor financing. Aside from bank loans, common options include:

- Invoice Funding: This involves selling outstanding invoices to a third party (a funding company) at a discount in exchange for immediate cash.

- Merchant Cash Advances (MCAs): Contractors receive a lump sum upfront in exchange for a percentage of future receivables.

- Line of Credit: A revolving line of credit provides flexibility, so you can draw funds as needed, up to a predetermined limit.

Each provides a quicker solution to cash flow challenges than bank funding, which gives you options for your specific needs of the contract.

Advantages of Government Contractor Financing

One of the main advantages of alternative government contractor financing is its flexibility. Unlike traditional banks, receivables funding, MCAs and line of credit provide quick access to capital for various needs, such as payroll and equipment. This is crucial if you need to maintain momentum on government projects without waiting for delayed payments.

Alternative financing can also allow you take on more contracts and enhance your credibility. Letters of support and immediate access to funds can help you secure larger contracts, complete projects on time, and strengthen relationships with government agencies.

Decision-Making Factors for Traditional vs. Alternative Government Contractor Financing

There are several key factors that government contractors should consider when deciding between traditional and alternative government contractor financing options:

- Project Timelines: If the contract requires fast execution and you need immediate funds, alternative financing may be the best choice.

- Cost of Borrowing: Traditional funding typically has lower interest rates, while government contractor financing offers faster access but at a higher cost. You must weigh the urgency of your needs against the long-term cost.

- Credit Requirements: Contractors with lower credit scores may find it difficult to secure traditional loans, making government contractor financing a more accessible option.

You must also look for red flags like unclear terms, excessive fees, or lack of transparency when evaluating funding options. Avoid financial pitfalls with thorough research and comparison of different funding providers.

Is Alternative Government Contractor Financing Right for Your Contract?

If your contract has tight deadlines or requires quick access to funds, alternative government contractor financing is likely the better choice. Traditional funding may be more cost-effective for long-term projects with more lenient timelines. Ultimately, the decision will depend on your cash flow, project timeline, and overall financial health.

Want Flexible Financing? Contact Encore Funding Today!

Interested in learning more about how Encore Funding can help your business grow with flexible government contractor financing? Apply now to learn about your eligibility and connect with an Encore team member!

info@encore-funding.com

info@encore-funding.com 216-998-9900

216-998-9900